One of the best ways to lower your mortgage payments is to refinance your mortgage. The cost of refinancing will depend on the type of loan you want. Your credit score, your credit history, your credit card amounts, your income, and your assets are all important factors in terms of whether or not you can refinance your mortgage. If you have a mainstream bank, they may offer more benefits, but they will also have more strict guidelines on things like credit scores.

Refinancing your mortgage is a smart way to get more out of your home. You may not be able to afford the monthly mortgage payments, or you might want to pay more than you can afford. Other reasons to refinance your mortgage include: to switch to a lower interest rate and shortening the mortgage term. Refinancing your mortgage is a smart way to get more out of your home. You may not be able to afford the monthly mortgage payments, or you might want to pay more than you can afford. Other reasons to refinance your mortgage include: to switch to a lower interest rate and shortening the mortgage term.

Table of Contents

Refinance to get a Lower Interest Rate

Now more than ever, securing a lower interest rate is a valuable way to save on debts. With a lower interest rate on a loan, you have a smaller monthly payment, which means you typically have a little more leftover on a monthly basis. Without a refinance, you may not even know that a lower rate is an option, and you may not even qualify for a refinance.

When you refinance your mortgage, you take out a new mortgage with a new lender, which has a new interest rate and terms. You close your old mortgage and start paying your new loan. The new loan might also be a 30-year mortgage instead of a 15-year mortgage – this means that it might take longer to pay off and you end up paying more interest over the life of the loan. However, you might end up paying less interest given the lower interest rates.

Also, Read: Things to Consider While Calculating Home Value Estimate

Refinance to short the term of the loan

If you thought you’d been tempted to refinance to get a better interest rate on your mortgage, make the decision now. When it comes to mortgages, the lower interest rates can make a huge difference in how much interest you pay over the long term. Refinancing to shorten the loan’s term is one of the best ways to make mortgage refinancing work for you. Not only will you save on interest over the first few years on the loan, but you’ll also start to see some substantial savings that will accumulate over time.

There are a number of good reasons that you might want to refinance your home. If you have a long-term fixed-rate mortgage, but you don’t want to go through the process of refinancing to take advantage of current low rates again, you might want to shorten the length of your mortgage, for example.

There are two reasons for refinancing a loan: to change the term from an open-ended to a closed-term or to convert from a variable-rate to a fixed rate. To refinance a loan to a closed-term, you’ll need to extend the current loan’s term to the new desired term. One situation where you may want to refinance a loan to a closed-term is if you feel that your property or investments won’t appreciate by the time the loan is paid back. If you’re on a variable rate and want to switch to a fixed rate, you’ll need to refinance and close the term and open the new two.

Refinance is used to Convert to an ARM or Fixed-Rate Mortgage

Refinancing your mortgage is a way to lower monthly payments and bring down interest rates if they’ve risen since you borrowed money. Refinancing to an ARM will lower monthly payments but may incur higher interest rates than a fixed-rate mortgage. When you refinance, you won’t need to provide a new appraisal, unless you want the ability to get a fixed-rate mortgage. There are two types of mortgage refinancing: fixed-rate mortgages and adjustable-rate mortgages.

Refinancing is an important step to making sure your finances are as large as possible and you can sleep at night knowing you’ve taken care of your property. When refinancing, you have the option to convert to an ARM or a fixed-rate mortgage. When converting to an ARM, you forfeit any equity and risk that property value drops and you cannot afford the new, higher monthly payments. That’s why we never recommend converting to an ARM. This article is about converting to a fixed-rate mortgage. With a fixed-rate mortgage, you know exactly what your ongoing monthly payments will be, and you also know exactly what you will pay in the end.

The best time to convert to a new mortgage is when you’re closing on a new property. For example, if you own a property and you’ve built up enough equity and you’re buying a new property, it’s usually a good idea to switch over to a new mortgage because it can be very expensive to refinance when you’ve already bought a new property.

Refinance is also used to get Equity or Consolidate Debt

Refinancing your mortgage or consolidating your debts are two ways to get your financial life back on track. Refinancing can help you save money each month, consolidate debt, and increase your monthly cash flow so you can focus on your financial goals.

Consolidating your debts is an easier approach to get rid of expensive debt that’s costing you an arm and a leg. One of the best things about refinancing is that it doesn’t take much time. It can save you money, help you get control of your debts, and pave the way for your financial future.

Refinancing to get equity or consolidate debt is one of the best ways to protect your wallet and your future. You can use equity loans or home equity lines of credit to have flexible access to cash, consolidate other debts, or both. You can use refinancing for other reasons, too. You might want to take advantage of a lower interest rate, get a mortgage pre-approval, or prepare for retirement. Whichever reason you have, it’s important to have the right knowledge.

Refinance will help you to get Cash To Pay Off Debts

Now that you’ve read the article, you should know that refinancing your mortgage is one of the best ways to get cash fast. You need to get rid of that expensive credit card debt, but you need the funds to do it. Luckily, refinancing your mortgage is a good option to bridge the gap. The only thing you’ll need to provide is equity in your home.

If you’re in a situation where you’re trying to keep your head afloat while still owing a large sum of money to a financial organization, your mortgage is a good candidate for a refinance. For example, if you or your family need to travel or move or if you want to put down a deposit for a new home because the one you’re living in is no longer big enough, you will need a sizeable amount of money. And if your organization offers a lower interest rate, these things are much easier to do. The best way to find a good rate is to compare what other companies have to offer.

Cash-Out Refinance to help you

A refinance mortgage loans are the new norm in the mortgage industry, for good reason. Beyond the traditional reasons like lower rates and lower monthly payments, refinancing has become popular with the addition of cash-out refinances for debt relief. A cash-out refinance is a type of mortgage loan where you borrow more money from your home equity in return for a cash-out in the event of a loan payoff. Like any home equity loan, when you use your home to borrow money it’s important to make the monthly payments when due, avoid increasing your credit card spends and avoid taking on new debts that can’t be reasonably paid off in a short period of time.

When you borrow more money than you can afford to repay, your debt starts snowballing. When your debt grows, your debt-to-income ratio increases too. These two factors can either derail your finances or help you refinance your mortgage. When you refinance your mortgage, you’re able to borrow more money than you currently have. You can use that money to increase your down payment or pay down your previous debt. So, you’re debt-free and debt-free. . It’s always better to refinance your mortgage than to take out a personal loan for debt consolidation purposes.

Why should I refinance my mortgage? There are many benefits to refinancing, and one of the biggest is a lower monthly payment. If you’re looking for a way to get rid of a high-interest loan and take advantage of a lower interest rate, a refinance might be for you. You’ll also get to take cash out of your home to help pay for anything you need. A cash-out refinance is perfect for people who want the flexibility of taking out money when they need it.

Cash-Out Refinance For Home Improvements Or Renovations

If you’ve already paid off your home’s mortgage, then you’ll want to look into refinancing so you can get the best possible interest rate. Powering debt refers to using debt to purchase assets. For example, you could use your increased monthly payments to pay down your mortgage, invest in your retirement account, or even buy something. If you’re looking to refinance your mortgage to take out money for home improvements or renovations, then you’re in the right spot. A cash-out refinance means that you take out cash when you refinance your mortgage.

A mortgage should not be used to manage cash flow, it should be used to manage mortgage debt. However, your mortgage debt may exceed the value of your home. If your current mortgage is not suited to your needs, it may be wiser to refinance. When you refinance, you have the option to take out extra money if you are unable to do this through your assets or 401k. You can then use this money to fix up your house, renovate, or take care of other things, freeing up cash flow.

For starters, having a low mortgage interest rate can mean you spend less on interest each month. This could save you a lot of money and allow you to increase your spending and help your house grow in value. If market interest rates fall and your homeownership has not, you may be able to take advantage of a cash-out refinance and borrow money for home renovations. It’s important to remember that you don’t want to spend more than you can afford on a home of your own. So if you’re considering a cash-out refinance of your mortgage, speak to a mortgage consultant to see if it’s worth doing.

Credit Score Improvement with Refinance

Credit score improvement is easier with a refinance. A refinance is a way to take out a new loan with better terms to pay off your existing mortgage faster. Credit scores improve when you pay off your loans. When you make your mortgage payment, your interest is applied to paying off your loan. This helps your credit score because your balances are going down. Consumers typically receive a credit score a couple of times a year. There are a number of factors that can be used to calculate it, including balances, amount of credit in use, length of credit history, and types of credit in use.

A refinance is a mortgage loan that uses the equity from your home to get a new loan for a better interest rate. A refinance can help improve your credit score and allow you to refinance your mortgage at a lower rate. If your credit score is over 680, you may qualify for a refinance, and if you do it.

Questions related Refinance Your Mortgage / Home

What types of loans are there for Home Mortgage Refinance?

You really only have two repayment options: fixed and adjustable. Fixed is fixed, and that gives you a set and fixed monthly payment. Adjustable options, on the other hand, fluctuate with current interest rates.

There are a number of great mortgages refinance loans out there, but they’re not all suitable for all borrowers. You’ll want to make sure you review all the details before you make a decision. For example, your down payment would be a key factor in choosing a mortgage refinance loan. There are a couple of types of fees for a refinance, refundable and nonrefundable. You’ll want to verify which type is best for you. The type of rates you qualify for will also depend on the term of the loan.

There are a number of different loan initiatives for home mortgage refinancing. Student loan and homeownership loan shares will need to be calculated and there is a limit of how many loans can be taken out. Plus, lenders need to be contacted and the fees and interest will need to be compared against other options. The benefits of refinancing will be worth it as the mortgage rate and the term will be much lower.

What types of refinances are there for home/mortgage?

There are two types of home mortgage refinances. Home refinance is also sometimes referred to as cash-out refinance. There’s the Home Equity Conversion Mortgage (HECM) or sometimes called equity conversion. Then, there’s the Home Appraisal Refinance Loan (HARL), or HARP loan. HECM is a government-insured refinance, meaning that if you pay off the house before the time is up, you will receive the money-back with no interest. The downside is that if you want to refinance for 30 years, you can only access HECM for 30 years because it is government-insured only. The maximum HECM limit for families varies by state.

You should take into account your current interest rates and other consumer protections as well as your home’s lead-time and whether you plan to stay in your home for a long time before considering a refinance. If you’re considering refinancing, you want to find out if your current lender offers the option of a “construction loan.” A construction loan is a loan that allows you to renovate your home before you have to start to repay the loan. It’s typically only available for people who have equity in their homes.

What you will need to qualify for a Home Mortgage Refinance?

When it comes to qualifying for a refinance for a home mortgage, the most important thing to make sure of is that you qualify for your mortgage. A refinance is when you want to get a new mortgage on the house you already own. The easiest way to make sure you qualify is to get a quote from a certified mortgage broker. Once a broker has a better understanding of your situation, they can help you get a clearer picture of your qualification. A mortgage broker will let you know how much you will be able to afford with a new mortgage, and what you can be approved for.

In order to qualify for a mortgage lender to provide a home-refinance, you need to have a good credit rating. You also need to have a steady enough income to cover your monthly payments, have a good amount of equity in the home, and have a good history with your lender.

The lender will need to have a current appraisal of the home, current credit, and sufficient equity. Lenders like to see a steady income and a good credit score, as well as sufficient equity in the home. For refinances, you’ll need 20 percent equity in the property, and the appraisal should be within six months.

What is the difference between APR and Interest Rate in Home Mortgage Refinance?

Your house is your biggest investment. It’s a big part of your life and you need to protect it. The difference between interest rate and APR is a hugely important thing to keep in mind when you’re going to be applying for a mortgage. Interest rate is the annualized cost of borrowing money, and APR is the annual equivalent of the interest rate. In other words, APR is what you would actually end up paying on the money you borrowed over the course of a year. APR includes financing costs from both the mortgage and from other expenses, such as property taxes. Understanding the difference between interest rates and APR is important for protecting your big investment.

A mortgage is a long-term loan used to buy a house. Interest rates are how much money you pay for the loan, and APR is a way to measure the total cost of the mortgage over time. The important thing to consider in the long run is the APR. This is because it will help you understand the actual APR and what you’ll be paying back in the future. The mortgage loan is typically broken up into two parts: the interest and the principal. The interest is calculated using the APR, and the principal refers to the outstanding balance of the mortgage.

The interest rate is the interest rate on your loan, such as 5%. APR is the calculated interest rate on your loan. APR is the annual percentage rate, so it is based on how often you can get your money out of your savings. This is typically over a year, but the amount of time the APR rate is used can vary. The difference between APR and interest rate is that APR is not the current rate you’re paying, but the “nominal” or “sticker” rate.

How floor plans can help in Refinancing Your Mortgage Home?

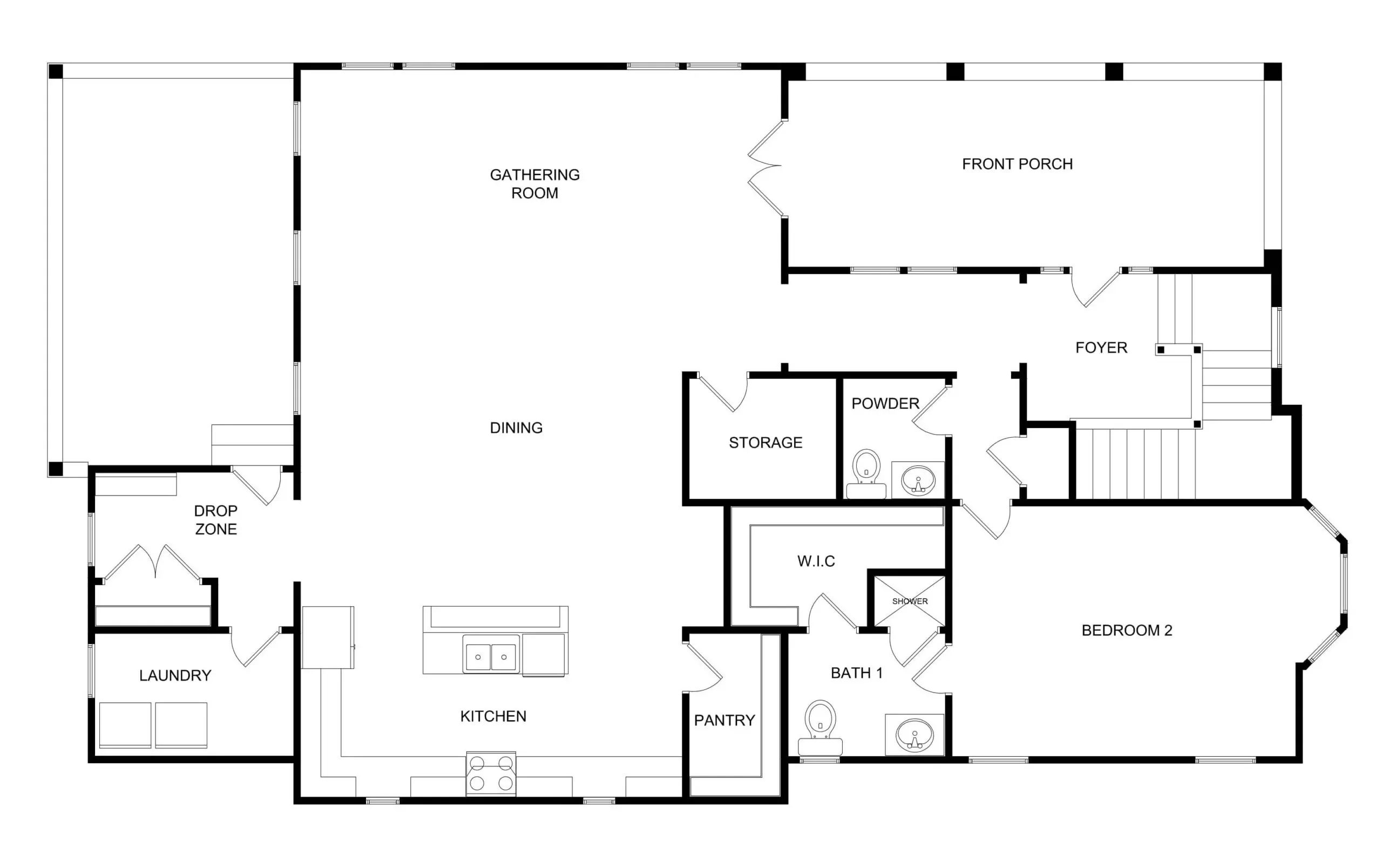

Floor plans and the layout of your home can affect your chances of getting a mortgage and the price you get for your home when you go to sell it. Floors that are not fully carpeted can reduce the value of your home by hundreds of dollars. The right layout can increase the value. Certain conventions such as using a formal living room and dining room can help your chances of getting a good price for your home.

A detailed floor plan is a crucial component for a loan application that requires a new appraisal. If a homebuyer needs a new appraisal, they need to provide an accurate floor plan. It’s also important for refinancing a mortgage for a home they already own. When it comes to refinancing a mortgage for a home you already own, the floor plans are expected to be even more detailed.

One way to refinance your home is by switching to a mortgage lender with better rates and terms. But another important step is to make sure you have a good understanding of what your current home’s square footage is. Why is square footage important? First, square footage dictates what type and amount of financing you qualify for and what size borrowing you can access. It also determines what the property taxes are. And last, but certainly not least, it can affect the property’s resale value. Using the MLS IDX Enhanced Property Search, it’s possible to find out your property’s size, which will help you make decisions around your mortgage.

2D floor plans in Refinancing a Mortgage

In order to discharge a residential mortgage – meaning to discharge a home mortgage – you have to get the proper paperwork together. For starters, you need to get a copy of the entire mortgage, any promissory notes, and any statements on fix-up money. When you refinance your mortgage, your lending institution will need to provide you with a 2D floor plan of your home. You’ll need this to get the mortgage. They will also need to see the elevation of the home, which is different than the floor plan. The elevation provides a top-down view of the house which will help the lending institution decide if the house is structurally sound. If it isn’t, you might not get approved.

2D floor plan drawings for building new houses are created to show the layout of an actual building or structure. These plans are often created to show how a home or building is currently laid out. This is why these floorplans are important in refinancing your mortgage home. They help you see how much space you’ll need for each area of your house or building.

3D floor plans used in Refinancing a Mortgage Home

Creating 3D floor plans is the future of construction and design, and you can see this innovation in the world of home refinancing. This doesn’t just mean that 3D floor plans for your home will help your mortgage lender see your real property in a whole new light. And it’s no longer just a feature in mortgage marketing, either.

When you’re refinancing your mortgage, it’s important that you know what your home’s true value is. You will be able to calculate this by using your home’s 3D floor plan. A 3D floor plan is the only way to go. The modern homeowner is exposed to so much information about their home. Make use of it! You can find 3D models of houses for sale on the internet or you can create your own 3D model, explore your home’s architecture, and accurately calculate its value with the help of a 3D floor plan.

3D Exterior Designs for Refinancing Your Mortgage Home

3D exterior rendering designs are becoming more and more important in the engineering field because they allow people to visualize what a structure will look like before it’s built. This allows architects and designers to fix any potential problems early on and it saves time and money. When it comes to refinancing, it’s important to understand how much your mortgage is currently costing you and it’s important to be informed about programs and rates. 3D models can help people decide if they want to refinance their mortgage and what would be the best option for them.

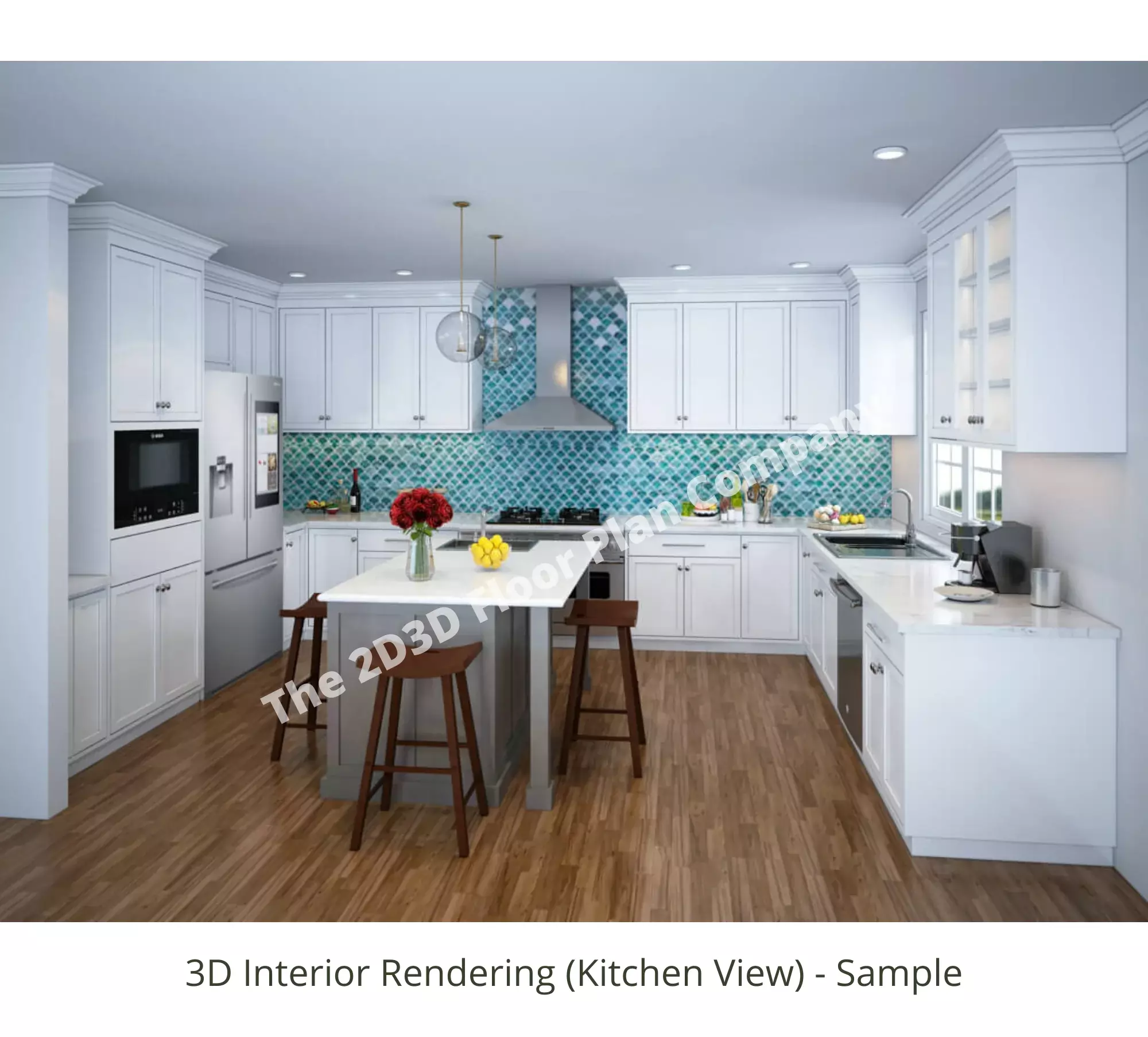

3D interior designs for Refinancing Your Mortgage Home

3D rendering interior designs allow you to see a digital representation of the space so you know how it would look if you decide to invest in a refi. It may seem a little extreme, but it’s worth going the extra mile to get an idea of how the space will look. A home buyer’s first impression is part of the first step of the sales process. And getting a first look at your space also helps you screen out buyers that may not be a good fit.

3D interior design is very important for the process of refinancing your mortgage. The 3D design allows you to see your new dream home. Most lenders will probably require you to use 3D design as a measure of verifying your offer. And as such, it is an important tool for helping you to plan for your future.