Things to Consider While Calculating Home Value Estimate: There are several avenues to discover how much your home is worth. But first, you need to distinguish what type of estimate you’re looking for. The first is a fair market value, which is how much a consumer or investor would pay. The second estimate is the assessed value which represents the value property taxes are based on. This article covers both estimates in-depth and how you can get either one.

There are so many factors to consider when calculating the value of your house, both on the inside and out. The cost of the property may also go up depending on any renovations or updates you make to the exterior, which means you would need to take these into consideration when deciding when to sell the property. You may want to hire a professional who can provide you with a detailed market analysis that will help you reach the best conclusion about how to best determine the cost of your home.

Table of Contents

Things to Consider While Calculating Home Value Estimate

Fair Market Value

The fair market value is the value your property is to a consumer or investor. It’s typically estimated based on similar properties. For example, if you own a 3 bedroom 2 bathroom house in a nice neighborhood and similar sized houses sell for $200k then your property will be valued similarly. Now, recent sales of a similar house aren’t the only factor, but they do play a large part in it. Other factors taken into consideration include amenities, house age, house condition, recent renovations, and location of the house.

Also, Read: What is a Duplex? Pros and Cons, Duplex Floor Plans

There are a few ways to determine the fair market value of your home. The first is to use free internet valuation sites such as Zillow or Redfin. These sites use proprietary algorithms and publicly sourced information to determine your home’s value. But be sure to use more than one method to determine the value of your home. A second way to determine the value is to contact a local real estate agent. These people generally have advanced knowledge of the areas they operate in and can access public sale records. A third way to get a fair market estimate of your home is to check with a bank or mortgage company. Banks give out loans for properties and mortgages and so they need to have a deep understanding of the area they lend in. Go to your bank in person and ask if they can estimate your home’s value or if they know anyone that can.

Quick tips for determining Fair Market Value of a Home

- Run a Comparative Market Analysis (CMA)

- Utilize Online Tools

- Find out recently sold homes in your area and check the recent sales prices

- Use a house price index calculator

- Connect with your local taxing authority, and try to get a copy of property tax assessment. Just try to review the recent property tax assessments

- Conduct a Home Appraisal of the property by a home appraiser (hire a professional appraiser)

Assessed Value

The assessed value is typically less than the fair market value because it’s solely based on the taxable value of the property. Special attributes for the property like home additions or upgrades typically are not included in the valuation. Below are steps to find your home’s assessed value.

Contact the assessor’s office for the county where the property is located. Most areas have features where you can search for property on the website. These areas allow you to search for property taxes and other things related to properties.

To search, simply provide the property address. If you inquire by phone or in person, give the address to the clerk who assists you.

Property taxes Vs Assessed values Vs Appraised values

Simple formula for calculating the Assessed Value

Different thoughts on calculation methods

Alternate method to calculate the assessed value

What Is a Home Appraisal?

A home appraisal is an evaluation of the market value of your home. It’s one way to determine whether or not your home is worth your asking price. The appraisal will take into account factors like size, condition, and recent sales in the neighbourhood. When you need an appraisal, it could be for a variety of reasons. It could be for a home you’re thinking of buying or selling or to find out what you should pay for a new home.

In general, an appraiser evaluates a house to estimate its value. A common appraisal can be used to determine a person’s eligibility for a loan to buy a house. An appraisal is typically done by a professional appraiser. The appraiser may make a professional appraisal or a lender’s appraisal. The lender’s appraisal is usually a quick calculation made by the lender. The person you are refinancing your house may also have his or her own appraisal to use for further calculations.

What Is a Home Appraisal Report?

The purpose of the home appraisal report is to give accurate information about the value of a property. The report is usually requested by a home buyer or seller. It determines the value of the property. The appraisal report should contain accurate market information about the neighborhood, the condition of the property, the zoning regulations, the general condition of the property, the comparables that were used to determine the market value, and it should be complete, accurate, and concise. The home appraisal report is used by lenders to evaluate the value of the property.

A home appraisal is an evaluation of a home that looks at the condition of the property and the market in that area. They’re often ordered before purchasing a home and can help the buyer decide on the price point and what they should offer for the house. A home appraisal report can either be an external or internal report. An external report is done by a third party who has no interest in this particular property. An internal report is done by a company who knows the property and the neighbourhood’s values and holds a stake in it.

A home appraisal is the process of getting the value of a property. It’s very important to know what the property is worth as it can affect whether or not you can afford to buy it. To get a professional appraisal, depending on where you live, you may have to pay a fee. Your real estate agent or lawyer can help you to prepare a “real estate market data form” which is a quick way to get a property appraisal. They collect a series of data from you so they can get a rough estimate of what the property is worth.

Real Estate Valuation Appraisal Methods

There are many different methods that can be used in the valuation appraisal process. The most common are the comparison, cost, income, and discounted cash flow approaches. There are benefits and drawbacks to all of them. A comparison approach is the easiest since it’s based on the most recent sales prices of properties similar to the appraised property. This method relies on looking at current market trends and the real estate market conditions.

Appraisal methods are just as varied as the number of appraisers in the industry. There’s no single field or theory that governs how we determine value or prices for all properties. The appraiser’s approach to determining value and prices for a particular property is based primarily on:

Method #1 Sales Comparison Approach

The sales comparison approach of appraisal is one of the most common and the most often used approaches. It is based on the comparison of the market value of a property to the price at which it has been recently selling and the prices of recent and recent and recent comparable sales. This is an approach where the total value of the property is known from the sale prices of all the comparable, sold properties.

The Sales Comparison Approach is often also referred to as the market value approach. Here, the appraiser’s opinion of the value of a property is reached by comparing it to recently sold properties.

Method #2 Cost Approach

In the cost approach, the appraiser starts with a list of all the land improvements and builds a cost estimate from there. This is a more subjective method, and the appraiser would have to know a great deal about the subject property in order to price all of these improvements accurately.

Real estate valuation appraisal is a tricky and difficult process and there is no one approach that will work best every time. Real estate valuation appraisal is a complicated and expensive exercise. Real estate valuation appraisal can be done several different ways and there is no one approach that will work best every time. Real estate valuation appraisal is not the same as an income or longevity study. Real estate valuation appraisal is a difficult and time-consuming process and it will involve a professional Real Estate Appraiser who will evaluate the property and determine an estimate of what it would be worth on the open market.

This is a method which calculates worth or value of property by estimating the replacement cost of the property. It enables determination of the property’s worth by estimating the cost of acquiring another property of similar desirability and location.

Method 3# Income Capitalization Approach

The income capitalization approach is a valuation method used for residential, commercial, heavy industrial, and retail properties. Under this approach, the current income generated by the property is used in our capitalization rate. The capitalization rate is then applied to expert appraised value. The resulting figure is the property value. Income is measured in the form of leases, rentals, or timeshare programs.

The Income Capitalization approach to real estate valuation relies on the future income stream from a given real estate property. It uses a measure of rent or sales price, whichever applies to the appraised property, and multiplies it by the length of the expected economic life of the property.

Why Should You Get a Home Appraisal?

A home appraisal is essential. It’s necessary when buying or selling a home because banks and mortgage companies won’t lend money if the appraised value is less than the loan amount. In addition, the housing market changes. It’s important to be aware of the ebbs and flows that occur in the real estate market and to be aware of your home’s current value.

Also, Read: Dryer Vents Do’s and Don’ts – Tips

It’s also important to figure out how you can raise your home’s value to its maximum. This can be done by comparing your home’s estimate with other homes nearby. Look at what made those homes sell for more or less and compare your home’s amenities with theirs. This can then lead to planning new projects that could raise the value of your home. For example, a 4 bedroom house could be selling for more than a 3 bedroom house and you may be able to add an extra bedroom. Small examples like this can raise the value of your home by thousands.

Also, Read: Best Home Design Ideas

When getting a home estimate be sure to consider the benefits and downfalls of the fair market value and the assessed value.

How floor plans are important while calculating Home Value Estimate?

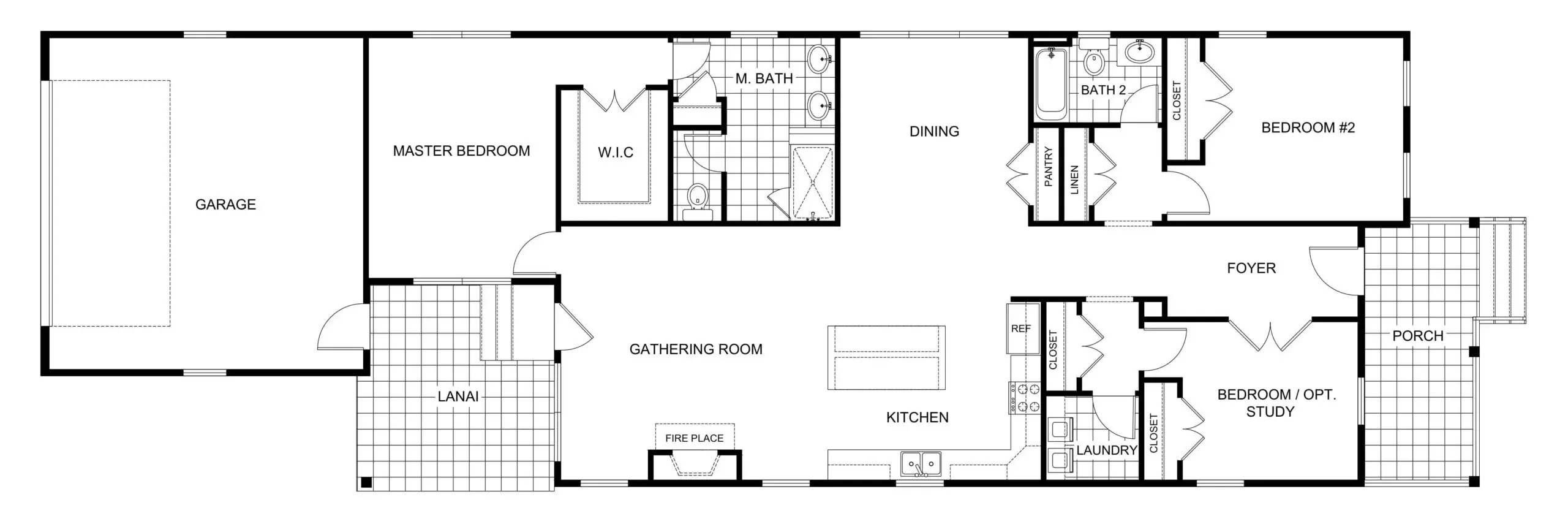

There are a lot of factors that go into making a great home, but one of the most important is its floor plan. When it comes to the value of a home, the floorplan is one of the biggest considerations. Whether you’re looking to buy or sell, the floorplan needs to fit your lifestyle and it needs to be well-designed. A small, cosy home is great for a family with children, while a more open, roomy design is good for first-time buyers.

When deciding what to sell or buy, it’s important to have a floor plan. It’s the first stage of the design process, and without it, you’re operating completely in the dark. It should show all your walls, doors, windows, furniture placement, landscaping, and other amenities. A ballpark estimate of the value of your property can be determined using a basic floor plan.

It’s important to have a floor plan drawn up by a professional. It’s illegal to photocopy a floor plan because it’s a violation of a copyright. Floor plans, available from a professional, show the typical layout of a typical floor in a typical house. They’ll show you where all the typical elements are, from the furnace, the stove, the water heater, to the toilet and the typical living room or dining room. They will also show you things like closets, the type of carpeting, the typical electrical layout, and the flooring materials. The floor plan will also dictate where windows, doors, and staircases are.

Role of 2D floor plans in Home Value Estimate Calculation

A 2D floor plan is the most important component for calculating the estimated value of a home. 2D floor plans have been around for a long time and have been a critical part of the home value estimate for a while. The floor plans show the dimensions of a room and provides a visual for a buyer to identify a home’s square footage. Neglecting the 2D floor plan while calculating a home’s estimated value will have an impact on how accurate the estimate is. The 2D floor plans allows the buyer to identify the potential of a space and to imagine where they want to add their own furniture. And without a 2D floor plan, buyers will have a hard time determining the square footage and its accurate value.

It is important to be aware that 2D floor plan drawings are not true representations of the space in the real world. Revisions are often necessary to take into account building depth, ceiling height, etc. If you want to know the exact price for your property, it is crucial to use a 3D home valuations service.

3D floor plans are important in Home Valuation

In order to calculate a home’s worth, it’s important to have a complete floor plan. The 3D floor plan will allow you to see your home from all sides. The more information you have, the better you’ll be able to estimate the value of the home. Using a 3D floor plan, you can visualize your home’s square footage, making measuring a lot easier! It also helps a lot when you’re trying to do a renovation project, since you’ll be able to get a better idea from the plans. Moreover, you’ll be able to estimate the cost of materials and other related features.

Rendered 3D floor plans are absolutely invaluable when it comes to estimating the value of a property. While they’re not always necessary, they can make it much easier for you to figure out an accurate estimate of the value. 3D floor plans are created through the use of 3D scanners which will capture the exact dimensions, shape, and angles of the interior and exterior of the property. These plans are used by restaurateurs, architects, engineers, architects, and developers. When you want to purchase or sell a property, 3D floor plans are an invaluable tool.

3D floor plans are now a standard part of any architectural design. 3D floor plans include the layout of the building, the placement of windows and doors, and any landscaping. It is now commonly used in residential projects for drafting estimates of the home value. It has helped homeowners near the end of their project to see what their new home will look like before they move in. This is a great time saver for both the homeowners and the architects. At the same time, the estate agents are giving 3D renderings to their clients, which saves them time looking at brochures or online.

3D exterior renderings are important for house worth calculation

3D exterior renderings are a critical part of the modern homebuying process because it allows you to see a visualization of a house before you buy it. 3D exterior renderings help you see a virtually complete picture of a house and can help you make a more informed decision about your purchase. This is why it’s been determined that 3D exterior rendering is an important part of the homebuying process. They allow you to see a visualof a house before you buy it, which can help you make a more informed decision about your purchase.

A 3D exterior home design is used to visualise your house, or your potential future house, in 3D geometry. The 3D exterior rendering will give you an idea of the spatial look and feel of the house. This will help you decide if this is the correct house for you. You can use 3D exterior renderings to give you an idea of the exterior of the house. These are architectural drawings that give you an idea of the structural features of the house, so you can see what the design is like. So 3D exterior renderings are important if you’re looking to buy or sell.

3D exterior renderings are an excellent way of ensuring potential new homeowners what the home they’re considering buying will actually look like. The benefits of 3D house front design are that they’re more realistic and accurate than 2D drawings. 3D renderings also show how the home would look in the time of day and in different seasons.

How 3D interior renderings will help you in Calculating the Home Value Estimate

Home valuations are a necessary part of buying a property, and a 3D interior mockup can help a potential buyer to see the true value of the home before they buy. A home’s true value can be drastically altered if there are architectural, construction, or design challenges that may not be apparent to the naked eye. It may not be obvious from the outside, but a 3D interior project can show you what lies between the walls and ceilings of your dream home.

3D interior renderings are a great way to show a potential buyer everything they need to know about a home, from the layout to the materials used in the construction. These renderings make it easy to show a potential buyer how the home would feel as if they were actually there. Using a 3D rendering helps eliminate the need for a lot of descriptive text and it’s a cost-effective option.

3D room design renderings of the inside of the home are an important asset for real estate agents or brokers when estimating the value of a house. These renderings allow them to show potential buyers the space they would be purchasing, giving them an accurate representation of what they’re buying. They’re also helpful in showing clients what they can actually achieve in their home. When you have a plan of the layout, you have the steps you need to take to achieve your dream home.

Frequently Asked Questions (FAQs) with Answers

How do appraisers calculate the value of a home?

When appraising a home, appraisers will look at many different factors in order to come up with an estimate of the home’s value. Some of the things that appraisers will look at include the home’s size, location, age, condition, and any recent upgrades or remodeling that has been done.

How do real estate agents estimate the value of a home?

Estimating the value of a home is done by considering many factors including the location, size, age, and condition of the home, as well as recent sales of similar homes in the area.

How do home buyers calculate the value of a home?

There is no definitive answer to this question as different home buyers will have different methodologies for calculating the value of a home. Some common methods that home buyers use to calculate the value of a home include considering the home’s purchase price, the cost of any renovations or repairs that need to be made, the value of similar homes in the area, and the expected resale value of the home.

How do home sellers calculate the value of a home?

Home sellers use a number of methods to calculate the value of a home. One common method is to compare the home to similar homes that have recently been sold in the same area. Another method is to use a home valuation tool, which takes into account a number of factors such as the size of the home, the age of the home, the location of the home, and recent trends in the housing market.

How do real estate agents calculate the value of a home?

Different real estate agents may have different methods of calculating the value of a home, but there are some general steps that are typically followed. Typically, an agent will start by looking at comparable sales in the area, also known as “comps.” They will look at the prices of similar homes that have recently sold in the same neighborhood. From there, they will adjust the prices based on the specific features of the home being valued. For example, if the home being valued is larger than the comps, the agent may adjust the price upward to account for the extra square footage. If the home being valued has special features like a pool or a view, the agent may also adjust the price upward to reflect the added value of those features.

Why do home values fluctuate?

Home values fluctuate based on many factors in the market. Some of these factors include the economy, inflation, market demand, and interest rates.

How can I estimate the value of my home?

The value of your home is based on many factors including location, size, age, amenities, and more. To get the most accurate estimate, you should consult with a real estate agent or appraiser.

What factors affect home value?

The three main factors that affect home value are location, physical characteristics, and economic conditions.

How do I know if I’m being offered a fair price for my home?

It depends on many factors including location, recent comparable sales in the area, the size and condition of the home, and more. A real estate agent can help you determine a fair market value for your home.

What is the difference between a home’s market value and its appraised value?

A home’s appraised value is the estimate of what a home is worth by a professional appraiser. A home’s market value is what a home is worth on the open market, determined by supply and demand. Generally, a home’s appraised value is lower than its market value.

What are some factors that contribute to a home’s value?

The value of a home is largely determined by its location. Other factors that can affect a home’s value include the condition of the property, the size of the property, the number of bedrooms and bathrooms, and the presence of amenities.

What are some methods for estimating a home’s value?

Some methods for estimating a home’s value are through its location, square footage, number of bedrooms and bathrooms, age and condition of the home, and recent sales of comparable homes in the area.

What are some common mistakes people make when estimating a home’s value?

The most common mistake people make when estimating a home’s value is using an online home value estimator. These estimators use public data and algorithms to generate a value estimate for a home, and they are often inaccurate. Another common mistake is relying on a real estate agent’s opinion of the home’s value. Real estate agents are often motivated by commission, and their estimates may not be accurate. Finally, people often underestimate the costs of repairs and renovations when estimating a home’s value.